Time-saving tactics: how fund selectors can avoid wasted work

In the first of a two-part series, Roland Meerdter, founder and managing partner of investment consultancy Propinquity, reveals how asset allocators can avoid wasted man hours on the hunt for top managers.

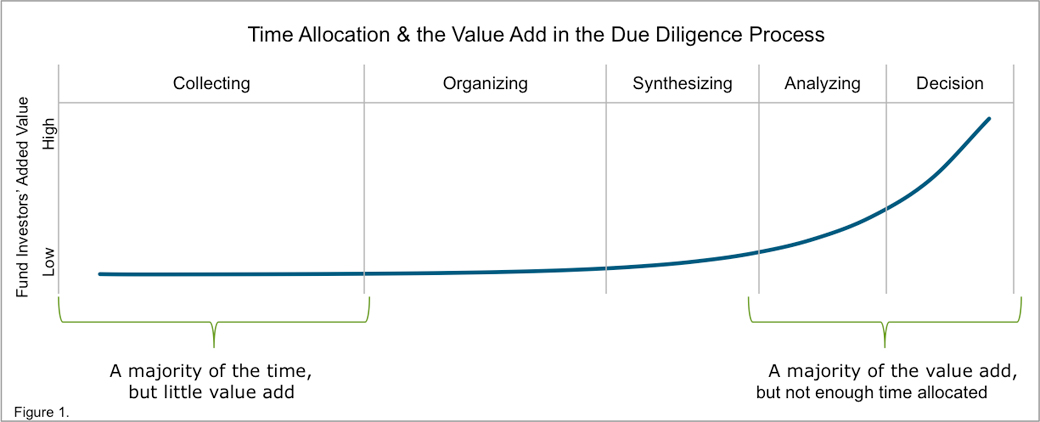

Professional fund investors are spending too much time gathering and organizing basic due diligence information on funds and not enough on analysis and decision-making. The problem is that the job is becoming more demanding in all the wrong ways.

Fund due diligence is about discovery, verification and comparative analysis. It is not about collecting and organizing information. It is not about checking boxes. It is determining which funds are best-in-class and then staying ahead of the curve of the changes that may dislodge their potential for long-term success.

To stay relevant, professional fund investors must focus on the areas where they can add the most value to client relationships, demonstrate their own worth and fulfill the obligations set out before them as fiduciaries.

They need the time and freedom to focus on what they do best. Currently, too much time and resource is committed to what has become a largely commoditized function: the collecting and organizing of the core information needed to perform due diligence.

The processes for collecting and organizing information are antiquated. Take for instance the sending of proprietary due diligence questionnaires that capture important – though largely commoditized – information; this process should be modernized.

Due diligence is driven by detailed information flow – the more accurate and timely the better. Current industry processes have not advanced since the advent of email.

Both the quality and timeliness of information coming from asset management companies to professional fund investors needs to improve to meet the pace of change driven by market complexity and regulatory demands.

And, not unlike the treatment of information for public companies, information crucial to decision making should be democratized such that all professional fund investors, regardless of size receive timely and accurate responses to data inquiries.

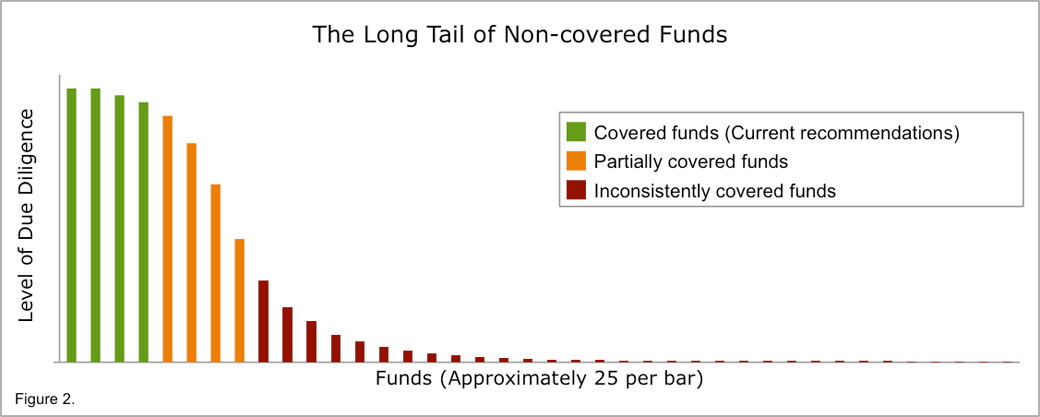

While a retail bank or wealth manager may have 100 ‘best in class’ funds on its current recommendation list, the range of funds held in client accounts is much larger and may be counted into the thousands. This reality is increasingly coming onto the radar of regulators. This ‘long tail’ of funds held by clients presents real risks.

When we think about the resources required to properly do such work, it is clear that, beyond current recommendations, the broad inventory of funds held by clients has the potential of lacking proper coverage.

The quick solution for this is to set up a series of quantitative screens to act as the monitoring process. Though a quick and easy solution, this approach runs counter to the robustness of process that incorporates in depth qualitative analysis for currently recommended funds.

Monitoring at the performance level is a gross oversimplification. Outsourcing of the task is another viable solution though expensive and exposed to the risks of ceding control to a third party.

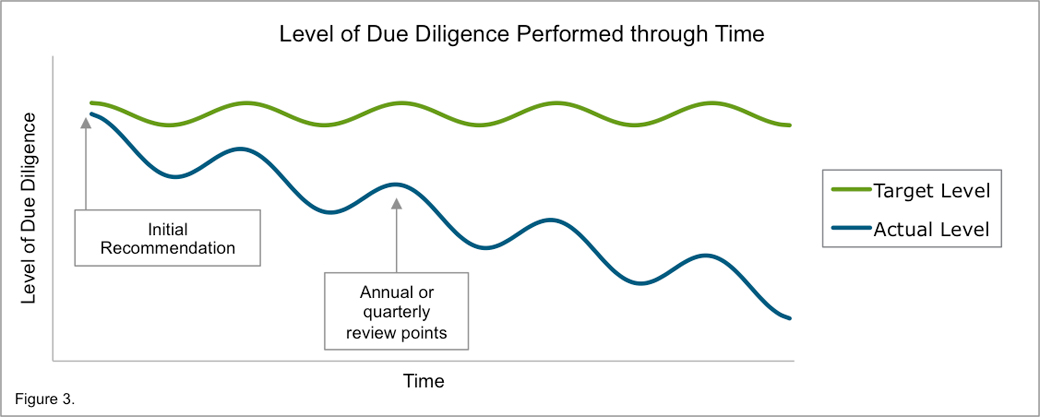

Regulators around the world are pushing fund investors to increase the breadth and depth of due diligence performed – not only on the currently recommended funds but on all funds held by clients.

Further, annual issuance and review of due diligence questionnaires are steadily being replaced by quarterly updates. Requests for portfolio level details – including fund holdings are becoming the norm.

Demands for due diligence will continue to grow; sizes of analyst teams are not. The investment landscape and available products are becoming more complex by the day. Regulators are driving change and demand for more oversight at an unprecedented rate.

Some are suggesting that the role of professional fund investors is being threatened by the shadow of robots. Robots are useful to a point. The real and immediate threat to professional fund investors, as well as the clients that depend on their insights, is the administrative burden that forces more time collecting and organizing data than analyzing it.

- Operations